US GDP Slows to 1.4% in Q4 2024 as PCE Inflation Accelerates to 2.9%

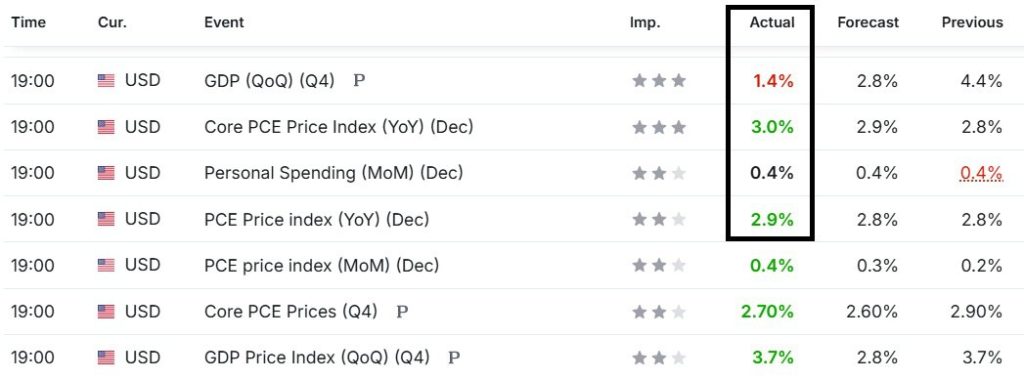

The latest economic data shows that US growth lost significant momentum in the fourth quarter of 2024. Quarterly GDP expanded by just 1.4%, far below the 2.8% forecast and sharply down from the previous 4.4% reading. At the same time, inflation pressures intensified, complicating the outlook for monetary policy.

This combination of slowing growth and rising inflation places the Federal Reserve in one of its most challenging policy environments in recent years.

Key Economic Data from Q4 2024

GDP Growth Weakens Sharply

US GDP rose only 1.4% in Q4, marking a major downside surprise compared to expectations of 2.8%. The previous quarter had posted a strong 4.4% reading, making the slowdown particularly notable. The data signals that economic momentum weakened more rapidly than markets anticipated.

The nearly one and a half month government shutdown during Q4 contributed to weaker output and reduced spending, directly weighing on overall economic growth.

Inflation Accelerates

While growth slowed, inflation indicators moved higher.

- The PCE Price Index YoY came in at 2.9%, above the 2.8% forecast and matching the highest levels seen since early 2024.

- Core PCE YoY rose to 3.0%, exceeding expectations of 2.9% and accelerating from the previous 2.8%.

- On a quarterly basis, Core PCE printed at 2.7%, slightly above the 2.6% forecast.

- Monthly PCE inflation increased by 0.4%, beating the 0.3% estimate.

Because PCE is the Federal Reserve’s preferred inflation gauge, the rise in Core PCE suggests that underlying price pressures remain persistent, even if other indicators such as CPI have shown some moderation.

Why This Matters for the Federal Reserve

The Federal Reserve now faces a growing policy dilemma.

Slowing growth typically calls for easier monetary policy to support economic activity. However, cutting interest rates while inflation remains above the 2% target risks reigniting price pressures. On the other hand, keeping rates higher for longer may help cool inflation further but increases the probability of deeper economic weakness.

With GDP undershooting expectations and inflation surprising to the upside, policymakers are caught between supporting growth and maintaining price stability. The current data strengthens concerns that stagflation risks are rising.

Outlook for Markets

Markets are likely to face extended policy uncertainty in the coming months. If growth continues to weaken while inflation remains elevated, the Federal Reserve’s room for maneuver will remain limited.

Investors should prepare for potential volatility across equities, bonds, and the US dollar as the central bank attempts to balance competing economic forces.