China’s $8 Trillion Foreign Assets Overtake Japan as Private Outflows Surge

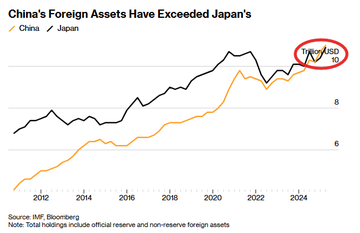

China has reached a historic milestone in global finance. In 2025, the country’s total foreign asset holdings rose above those of Japan for the first time, driven almost entirely by an unprecedented wave of private capital flowing overseas. Unlike previous cycles dominated by official reserve accumulation, this shift reflects a decisive move by households and corporations expanding their global investment footprint.

Key Developments in China’s Foreign Asset Expansion

Private Capital as the Primary Driver

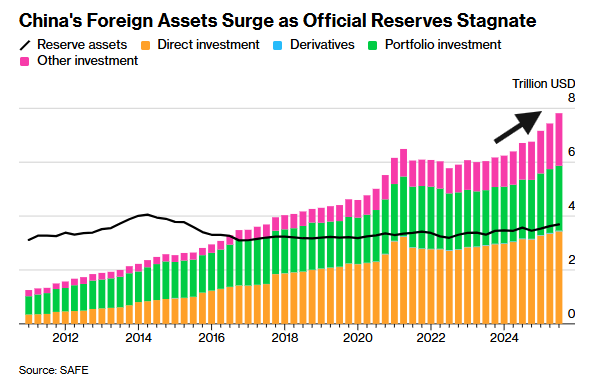

According to data from China’s currency regulator, private foreign asset holdings climbed to nearly $8 trillion, with more than $1 trillion added in just the first nine months of 2025. Official foreign exchange reserves, by contrast, remained largely unchanged during the same period, underscoring the private sector’s dominant role in this transformation.

The pace of accumulation has been striking. The steady upward trajectory in China’s total foreign asset position highlights one of the fastest expansions on record, signaling a structural shift rather than a short-term anomaly.

Portfolio Investment Surge

Bloomberg estimates show that Chinese private investors purchased approximately $535 billion in overseas securities throughout 2025. These investments spanned a broad range of assets, including US equities, European bonds, and global mutual funds.

While geographic allocation details remain limited, the scale is historic. Bloomberg’s calculations indicate that the increase through September alone exceeded any full-year surge in outbound portfolio investment recorded over the past two decades.

Why This Shift Matters

China Becomes a Net Creditor

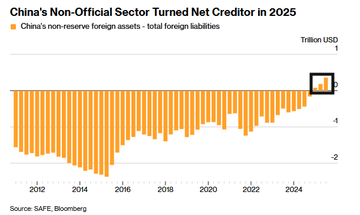

The surge in private overseas assets has fundamentally altered China’s external balance sheet. For the first time on record, non-reserve foreign assets minus total foreign liabilities turned positive in 2025, effectively making China a net creditor nation.

Economists at Bank of China International Securities, including Guan Tao, describe 2025 as a potential turning point. As Guan Tao noted, “2025 may mark the beginning of China’s transition toward becoming a mature net creditor nation.”

Rising Sensitivity to Currency Expectations

This transformation also suggests a behavioral shift. Analysts point out that the private sector is now more responsive to expectations surrounding yuan appreciation, indicating a deeper integration of market signals into investment decisions.

Global Implications

China’s private overseas holdings now amount to more than one-quarter of the entire US Treasury market, giving Chinese investors unprecedented potential influence across global capital markets.

Such scale reshapes China’s role in international finance—from a state-driven reserve accumulator to a decentralized global investor with diverse asset exposure.

Early Signs of Capital Returning Home

Despite the massive outward flow, official data suggest early indications of capital inflows reversing course. December recorded $128 billion in inflows, the largest monthly figure on record and the strongest since 2015. Corporations were observed converting foreign currency back into yuan at unusually elevated rates, hinting at shifting expectations or tactical repositioning.

Outlook for 2026

If current dynamics persist, China’s private sector is likely to remain a dominant force in global capital flows. However, the balance between outbound diversification and inbound repatriation will depend on currency trends, domestic growth expectations, and global financial conditions.

Sources: Neil Sethi