EUR/USD News: Focus Shifts to Liquidity Zones

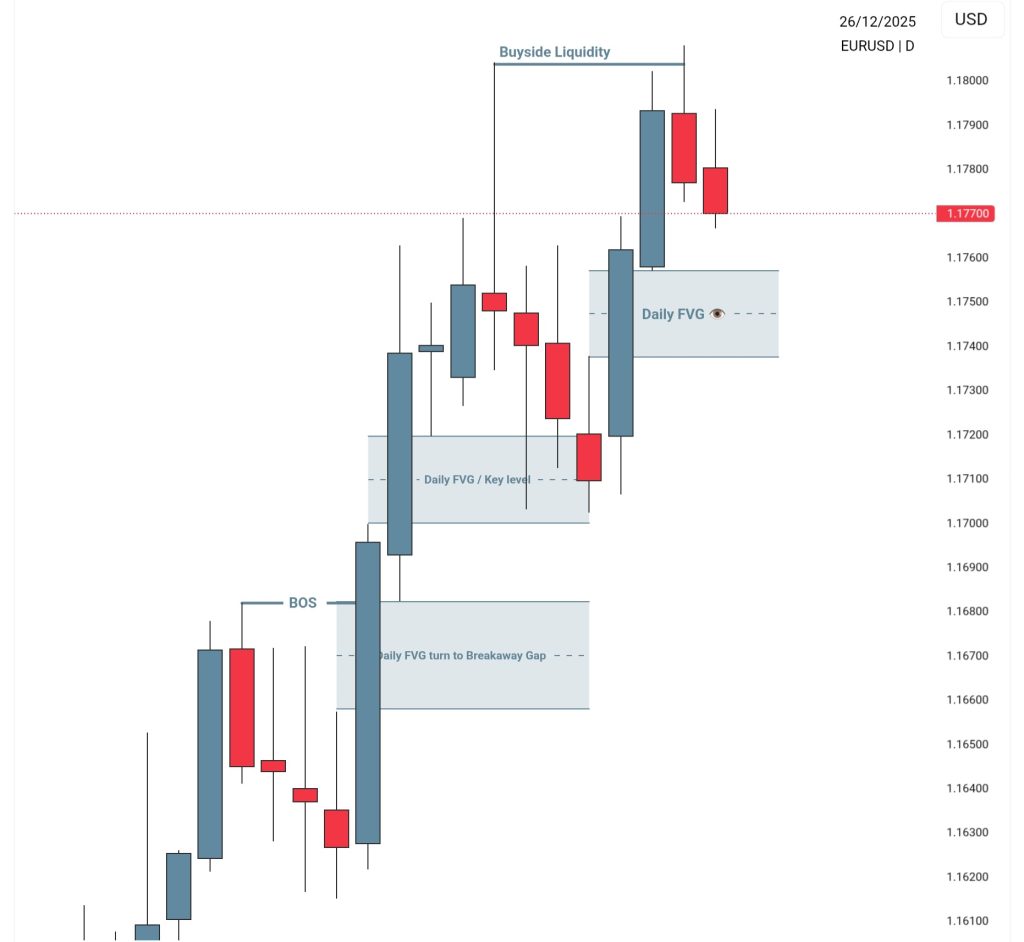

- A new EUR/USD News analysis explains how the pair moves between internal and external liquidity areas rather than randomly, highlighting the importance of fair value gaps and key highs and lows. Internal price ranges include execution features such as fair value gaps, minor highs and lows, and dealing-range dynamics that reflect accumulation and manipulation phases. The external range, by contrast, represents liquidity draw targets such as previous-day highs and lows, equal highs or lows, and major swing points where the market ultimately seeks to collect resting liquidity.

- EUR/USD News coverage also notes that several daily fair value gap zones remain active on the chart, marking important areas where price may rebalance before moving on toward liquidity objectives. Internal range execution typically occurs within these gaps and minor structural pockets, giving the market room to accumulate orders. The current EUR/USD structure highlights how the pair has tapped internal zones multiple times, while external levels such as prior highs remain key reference points for potential liquidity delivery.

Internal to External Price Delivery… price movement is structured and not random.

- The broader EUR/USD News narrative suggests that understanding this liquidity-delivery framework can help explain otherwise confusing movements. Internal levels guide short-term reactions, while external highs and lows continue to attract directional moves as drawn-liquidity targets. The concept reinforces the view that price does not move randomly but instead follows a consistent logic tied to liquidity placement. According to the chart analysis, buyside liquidity positioned above recent price action represents the true objectives where the market ultimately seeks to collect resting liquidity.

- Ultimately, this perspective matters because it reframes EUR/USD News analysis around where liquidity sits rather than simple support-resistance views. Tracking internal fair value gaps alongside external swing highs helps clarify directional bias and highlights where significant liquidity could be released next in the market.

My Take: This liquidity-focused approach offers traders a clearer roadmap for EURUSD movements by distinguishing between internal execution zones and external targets. Understanding where liquidity pools sit can significantly improve entry and exit timing.

Source: Sir Hisham