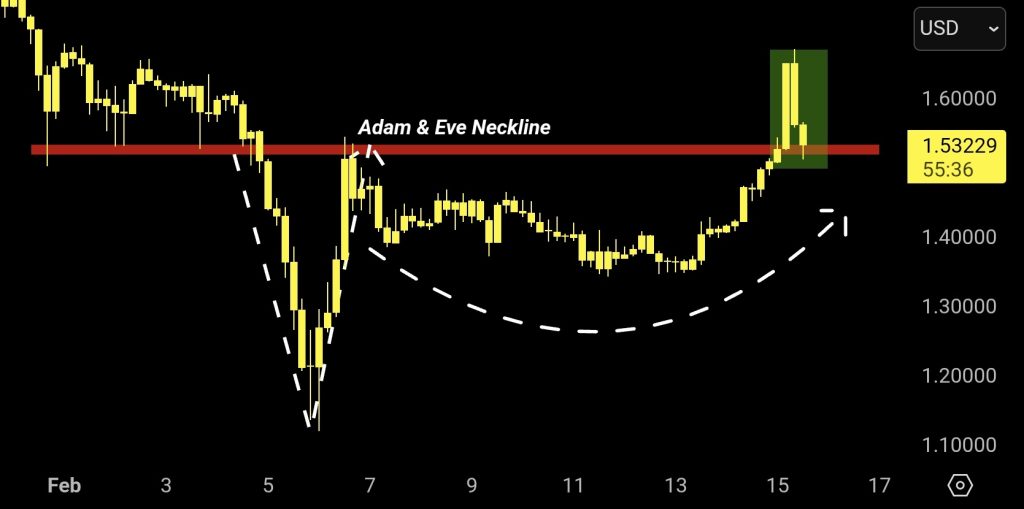

XRP Price Prediction: $1.50 Neckline Retest in Focus

A significant technical development has emerged in XRP price action. The asset recently broke above a well-defined Adam & Eve neckline near $1.50 and is now retesting that same level as potential support. This retest could determine whether the breakout evolves into a sustained bullish continuation or turns into a failed move.

The setup reflects classic breakout behavior, where former resistance becomes a key support test and serves as confirmation of buyer strength.

Technical Structure and Breakout Confirmation

The Adam & Eve Pattern

The chart structure shows a clear breakout above the horizontal resistance zone labeled as the Adam & Eve neckline. After clearing that level, XRP pulled back in a controlled manner toward the $1.50 area. This type of retest is common in bullish continuation patterns. If buyers successfully defend the neckline, it would confirm that resistance has flipped into support, reinforcing the broader bullish structure.

Weekend Volatility and Market Conditions

Current price action is unfolding during lower-liquidity weekend conditions, which often increase volatility and the probability of false moves. Reduced participation can exaggerate price swings, making it especially important to wait for confirmation before drawing firm conclusions about direction.

Why the $1.50 Level Matters

The $1.50 zone now represents the central technical pivot for XRP. If price remains above this level and forms a higher low, the breakout structure would be validated and momentum could build for a continuation move. However, if the level fails to hold, the breakout may be classified as a fakeout, increasing the likelihood of a return to the previous consolidation range. Because $1.50 carries both technical and psychological significance, market participants are closely watching how price behaves around this area.

Upside Scenario: Move Toward $1.80

Should XRP confirm support at $1.50 and establish a higher low, the next projected upside objective sits near $1.80. That zone represents the next structural resistance level on the chart and would mark a meaningful bullish continuation. A sustained move toward $1.80 would validate the Adam & Eve breakout pattern and potentially attract additional buying interest.

Downside Risk: Fakeout and Pullback

If XRP fails to maintain support at $1.50, the breakout could prove to be a fakeout. In that case, price may retrace back into the prior trading range, placing short-term pressure on recent buyers. Increased volatility could follow, particularly if stop-loss levels are triggered below the neckline.

Outlook

For now, XRP price action remains centered on the $1.50 neckline. The market is consolidating at a technically critical level, and patience remains essential during this phase. Whether the neckline confirms as support or fails will determine if XRP continues toward $1.80 or shifts back into range-bound conditions.