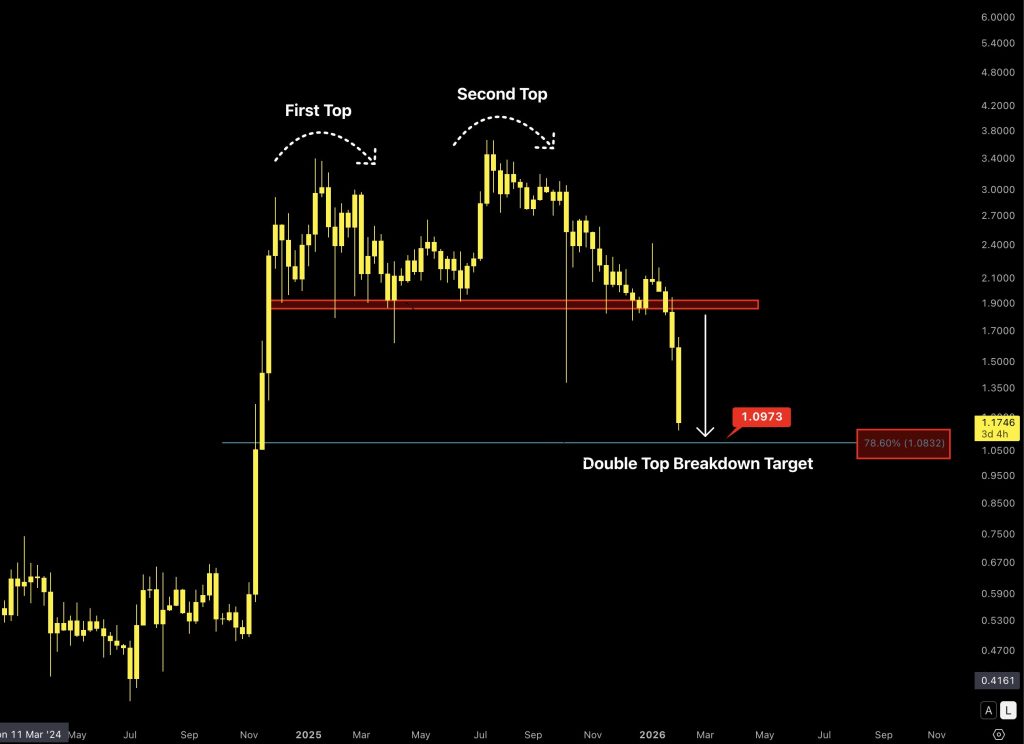

XRP Price Analysis: Double-Top Breakdown Puts $1 Support at Risk

XRP has entered a sharp corrective phase after confirming a classic double-top formation on the chart. The asset has now lost a key level of market structure, signaling a decisive shift in momentum from bullish consolidation to bearish continuation. Recent price action suggests downside risk is increasing as sellers take control.

Key Technical Breakdown Signals

Double-Top Pattern Confirmation

XRP was repeatedly rejected near the same resistance zone, forming two distinct highs before rolling over. This price behavior completed a textbook double-top pattern, a structure often associated with trend reversals. The subsequent breakdown below horizontal support confirmed the pattern and marked the start of accelerated selling pressure.

Breakdown Target and Fibonacci Confluence

Following the loss of support in the mid-$1 range, XRP moved swiftly lower. The measured downside target from the double-top formation points toward approximately $1.09. This level closely aligns with the 78.6% Fibonacci retracement near $1.08, reinforcing the technical significance of the broader $1 support zone as the next major downside target.

As noted in the analysis, XRP has now lost a key level of market structure, confirming a bearish shift in momentum.

Downside Risk Below $1

The chart suggests that a clean breakdown below the $1 handle would significantly increase downside vulnerability. Below this level, structural support is limited until the $0.70 region, which previously acted as a consolidation base. The steep nature of the decline following the breakdown indicates aggressive distribution rather than a controlled pullback, consistent with classic double-top behavior.

Why This Matters for the Crypto Market

XRP remains one of the most liquid and widely followed assets in the crypto market. As a result, its technical breakdown carries broader implications for market sentiment. A confirmed double-top often signals a transition from low-volatility consolidation to a period of expanded volatility. Whether XRP stabilizes near $1 or continues lower may influence short-term risk appetite across the altcoin market.

Outlook and Technical Bias

The current technical setup is decisively bearish. XRP’s failure to reclaim its former resistance zone and the subsequent breakdown suggest sellers remain firmly in control. If the $1 level fails to hold, downside momentum could accelerate, opening the door to a deeper move toward the $0.70 region. Until price reclaims lost structure, rallies are likely to face selling pressure.

Source: ChartNerd