XRP Ledger Surpasses Solana with $100M in RWA Tokenization Value

The XRP ecosystem is gaining momentum in institutional tokenization markets as the XRP Ledger recently surpassed Solana in total real world asset tokenization value. According to crypto researcher Ripple Bull Winkle, “XRPL just overtook Solana in Real World Asset tokenization value.”

This milestone signals growing institutional engagement with XRPL infrastructure, particularly in tokenized bonds, funds and structured financial instruments.

Key Developments in RWA Tokenization

XRPL Overtakes Solana

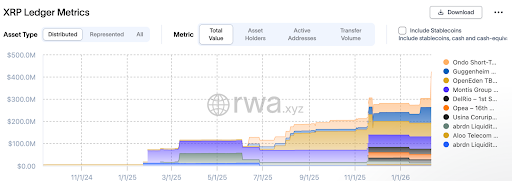

Data shows a steady upward trajectory in distributed tokenized value across the XRP Ledger over the past year. Cumulative value has climbed into the mid hundreds of millions of dollars, pushing XRPL ahead of Solana in RWA issuance.

The chart illustrating XRP Ledger metrics highlights continued growth in distributed asset value, reflecting expanding enterprise use cases beyond speculative trading.

Institutional Issuers Driving Growth

Several institutional grade issuers are contributing to this expansion, including:

- Ondo Short-Term Treasuries

- Guggenheim bond products

- OpenEden funds

- Additional regulated financial offerings

This composition suggests that growth is being driven by real financial issuance rather than retail speculation or meme based tokens. The increasing presence of tokenized bonds and structured products reinforces XRPL’s integration with traditional finance markets.

RLUSD Surpasses $1 Billion

Ripple-linked RLUSD has scaled from zero to more than $1 billion in supply. It has also achieved full integration on Binance, significantly improving liquidity and ecosystem accessibility.

The combination of RWA issuance growth and stablecoin expansion strengthens XRPL’s position as infrastructure capable of supporting institutional scale activity.

Why This Matters

Institutional blockchain adoption tends to favor networks with reliable infrastructure and compliance friendly frameworks. XRPL’s progress in real world asset tokenization reinforces this dynamic.

While price action continues to attract retail attention, the expansion of institutional plumbing represents a deeper layer of ecosystem development. The emphasis on tokenized bonds and funds shows how distributed ledgers are integrating with traditional finance markets.

This development complements narratives such as XRP testing resistance zones coverage and broader XRP price prediction paths ahead and break structures that could trigger market squeezes. It also aligns with XRP price analysis on short squeeze dynamics, which connects technical setups with underlying fundamental growth.

Outlook for XRPL and Institutional Adoption

XRPL overtaking Solana in RWA value highlights a network gaining traction within institutional tokenization pipelines. As regulatory clarity improves and tokenized assets continue to proliferate, platforms that enable compliant asset issuance and scalable liquidity may define real world blockchain adoption.

XRP’s expanding role in real world asset tokenization suggests that the ecosystem is evolving beyond retail driven trading cycles and into financial infrastructure leveraged by asset managers and liquidity providers.

My Take

XRPL surpassing Solana in RWA tokenization represents a quiet but meaningful shift. While market participants focus on short term price movements, the more significant development may be institutional capital choosing compliance friendly infrastructure over speculative narratives.

RLUSD reaching $1 billion and achieving Binance integration adds another layer of legitimacy. Over the long term, that distinction could separate XRP from purely speculative digital assets.

Source: Twitter Post by Ripple Bull Winkle | Crypto Researcher