Ethereum (ETH) Price at Risk: Key Support Levels at $3,960 and $3,360

Ethereum is sitting at a crossroads right now, and the next few moves could be make-or-break for the bulls. With the crypto market showing mixed signals, traders are laser-focused on some key price levels that have deep on-chain significance. These aren’t just random numbers on a chart – they represent real money and real decisions from investors who’ve put their ETH on the line.

Ethereum Price Faces Crucial On-Chain Test

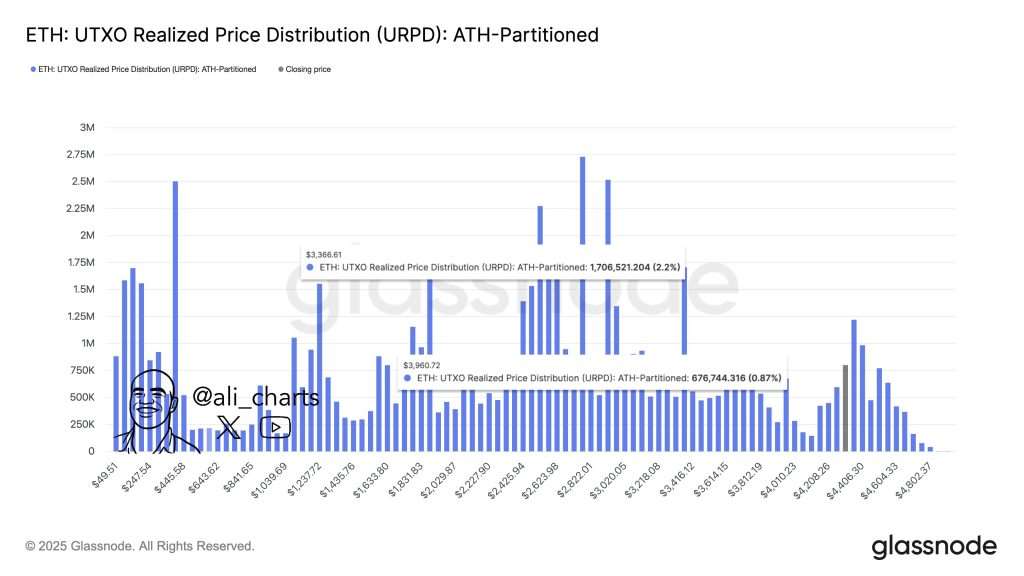

Ethereum is getting plenty of attention as everyone tries to figure out where it’s heading next. The folks at Glassnode have crunched the numbers on their UTXO Realized Price Distribution, and they’ve pinpointed two levels that really matter: $3,960 and $3,360. These are the spots where tons of ETH last changed hands, making them super important for understanding whether Ethereum can hold its ground.

Crypto analyst @ali_charts has been highlighting just how crucial these price zones are. He’s pointing out that these represent the biggest clusters of realized prices for Ethereum. If ETH breaks below these levels, we could see some serious turbulence and potentially a much deeper drop.

Here’s where it gets interesting – the on-chain data shows some massive concentrations of ETH at these levels. Around $3,366, there’s over 1.7 million ETH sitting there (that’s about 2.2% of all ETH in existence). Then you’ve got another 676,000 ETH (0.87% of supply) that was picked up around $3,960.

These aren’t small amounts we’re talking about. When you see clusters this big, it means there are a lot of people who have skin in the game at these prices. Right now, ETH is trading pretty close to that upper support area. If it can hold above $3,960, the bulls might have a chance to push things higher. But if that level gives way, we’re probably looking at a test of $3,360 – and that’s where things could get really interesting.

ETH Price Distribution Reveals Heavy Clusters

Ethereum still has a lot going for it from a fundamental standpoint. The DeFi ecosystem is humming along nicely, and people keep staking their ETH, which is generally a good sign. But from a technical perspective, the next few days are going to be crucial.

If the bulls can successfully defend that $3,960 level, we might see ETH bounce back toward the $4,200–$4,400 range. That would be a nice recovery and could get people excited about higher prices again. On the flip side, if that support breaks, gravity could pull ETH down to $3,360, and that’s when we’d probably see some panic selling from people who can’t handle the heat.

The bottom line is that Ethereum’s price action over the next little while is going to come down to how it behaves at these critical levels. Traders need to stay sharp because the next move could set the tone for weeks to come – whether that’s a resumption of the uptrend or a deeper correction that tests everyone’s patience.