ETH Price Analysis: Ethereum Stuck Between 50 and 200 EMA in Weekly Compression

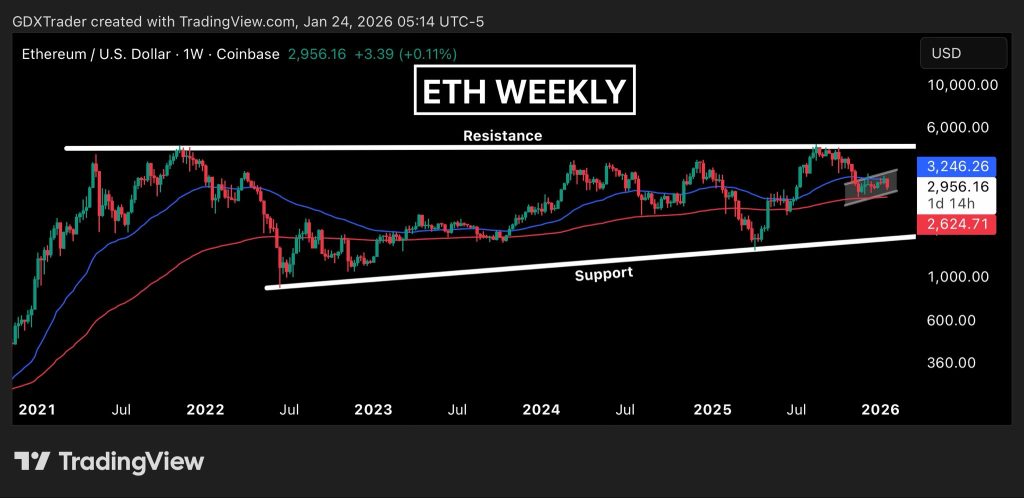

Ethereum remains locked inside a long-term weekly base, where market structure reflects compression rather than opportunity. Although price action may initially appear constructive, the broader technical context suggests hesitation, with neither bulls nor bears showing enough conviction to control direction.

Key Technical Signals

Weekly Market Structure and Resistance

Structurally, Ethereum has been forming higher lows while repeatedly failing to break through flat overhead resistance. This price behavior resembles an ascending triangle at first glance, but recent developments weaken the bullish interpretation.

Repeated rejections near the 50-week exponential moving average indicate that supply remains active at this level. Last week’s bearish engulfing candle further confirms that sellers are defending this zone, limiting upside follow-through.

Compression Between Key Moving Averages

Ethereum is currently trading between the 50 and 200 EMA on the weekly chart, leaving price trapped mid-range. This positioning reflects balance rather than control, with neither buyers nor sellers able to assert dominance.

Overlapping candles and a tightening range reinforce the view that the market is compressing. Instead of trending, ETH is consolidating within a narrow technical corridor, reducing the quality of directional trade setups.

Why This Matters

Markets that trade inside compression zones often punish impatience. In Ethereum’s case, bulls appear unwilling to chase price higher without confirmation, while bears remain comfortable leaning into moving-average resistance.

This dynamic creates a low-quality trading environment where risk-reward deteriorates for both sides. Until price resolves the compression, attempts to force trades inside the range carry elevated execution risk.

As noted in the analysis, there is no high-probability setup until Ethereum decisively resolves this structure. For a short-term bullish outlook to improve, ETH must reclaim the 50 EMA and invalidate the developing bear-flag-like formation.

Outlook and Key Levels to Watch

Patience remains the preferred strategy. A sustained reclaim of the 50 EMA would be required to restore bullish momentum on the weekly timeframe. Conversely, a loss of the 200 EMA could open the door for a move back toward ascending support, potentially offering a cleaner and more favorable entry than trading the middle of the range.

For now, Ethereum’s weekly structure favors discipline over action. The market is signaling indecision, and confirmation—not anticipation—will be needed before the next meaningful directional move emerges.