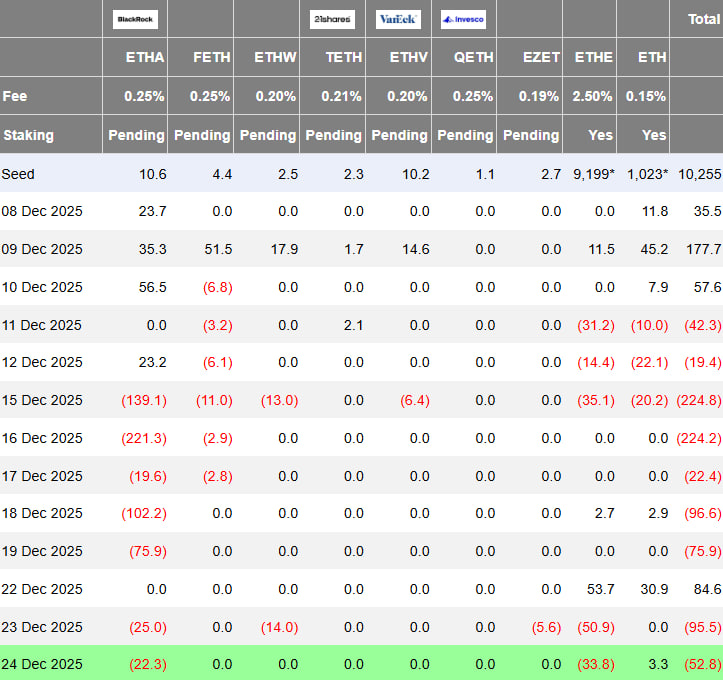

ETH ETF Outflows Hit $52.8M as BlackRock Exits $22.3M in Single Session

- ETH-linked ETF vehicles saw a sharp outflow session, with $52,800,000 withdrawn in a single day and BlackRock alone selling $22,300,000 worth of ETH exposure. The data, shown in a fund-flow table across multiple ETH products, reflects a meaningful shift of capital away from ETH ETF structures and has drawn attention across ETH Coin News coverage. The Proposal & Risks context here relates to how large ETF outflows can signal short-term caution and raise the risk of liquidity stress or sentiment deterioration if redemptions persist. The scale of withdrawals underscores how rapidly institutional capital can reposition when market conditions change.

- The Financial Impact & Alternative aspect of the story comes from the fact that the total $52.8 million exit represents a notable transfer of capital out of ETH ETF exposure in just one session. BlackRock’s $22.3 million outflow highlights the influence of major asset managers on ETF flow trends. While this activity is not linked to fiscal budgets or tax measures, large outflows can still affect perceived market strength and trading dynamics within the Ethereum ecosystem.

ETH ETF outflow of $52,800,000 yesterday. BlackRock sold $22,300,000 in Ethereum.

- At the same time, discussions within ETH Coin News circles continue to note that inflows into other investment vehicles or direct ETH spot holdings may offset ETF-based redemptions in the future.

- Broader Context & Consequences are visible in the table, which shows that outflows were not isolated to a single issuer. Multiple ETH products recorded negative flows on the day, contributing to the net $52.8 million reduction in ETF-held ETH exposure, while a small inflow was also present in another product. Although unrelated to proposed tax amendments, fund movements of this magnitude often influence sector allocation decisions, liquidity conditions, and overall market sentiment.

- This matters because ETF flows are widely seen as a proxy for institutional positioning toward ETH. Continued net outflows may reflect defensive sentiment, while a return to sustained inflows would indicate renewed appetite for ETH exposure and could help stabilize market confidence.

My Take: The $52.8M ETH ETF outflow shows that institutional investors are actively reducing exposure to Ethereum products. BlackRock’s $22.3M exit alone signals caution among major players, and if this trend continues, it could weigh on ETH price stability in the near term.

Source: Ted