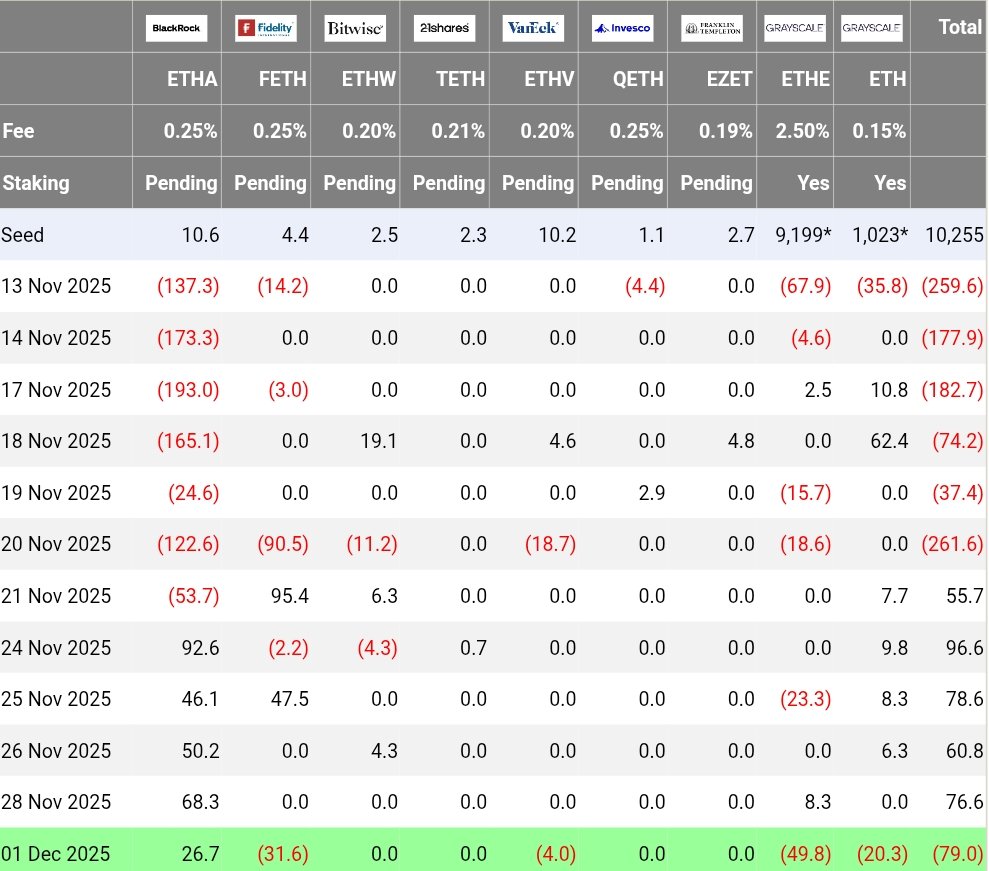

ETH Coin News: ETF Outflow Hits $79M Despite BlackRock’s $26.7M Buy

- Ethereum exchange-traded funds just recorded one of their most dramatic outflow days, with $79 million leaving ETF products even as BlackRock scooped up $26.7 million worth of ETH. The massive gap between institutional buying and redemptions comes as regulators weigh new crypto tax policies that could fundamentally reshape how digital assets are treated.

- The tax proposals on the table have sparked serious concern across the industry. Market participants are warning that rushed implementation without proper economic analysis could trigger bankruptcies among smaller crypto firms and push top talent toward countries with friendlier regulations. The $79 million outflow shows just how quickly money moves when uncertainty creeps in.

The scale of the $79 million outflow illustrates how quickly liquidity can shift when uncertainty intensifies.

- Here’s where it gets interesting: early projections suggest that aggressive tax changes might actually hurt government revenues if they push capital offshore. Industry leaders are floating an alternative—raise profit taxes on major crypto players instead of piling on operational tax burdens. This approach, they argue, would keep liquidity flowing in the Ethereum market while still filling government coffers. BlackRock’s $26.7 million purchase proves institutional appetite is alive, but analysts caution that policy confusion could dry up these inflows fast.

- The stakes go beyond ETF numbers. Proposed amendments touch everything from operational requirements to reporting standards and product classifications. Experts estimate poorly designed regulations could eliminate thousands of industry jobs and shrink both income and profit tax revenues. The ETF data backs up fears that Ethereum products are extremely sensitive to regulatory winds.

- The current split—$79 million out versus BlackRock’s $26.7 million in—reveals a market that’s increasingly reactive to policy signals. Institutional buyers may keep accumulating selectively, but real stability won’t arrive until regulators provide clear rules.

My Take: This outflow isn’t just about one bad day. It’s a stress test showing how fragile confidence is when tax policy remains unclear. BlackRock’s continued buying suggests smart money still sees value, but retail and smaller funds are clearly spooked.