Dogecoin Whales Keep Buying as Price Rises

- Dogecoin’s largest holders are adding to their positions while the price climbs, suggesting strong confidence before a possible rally.

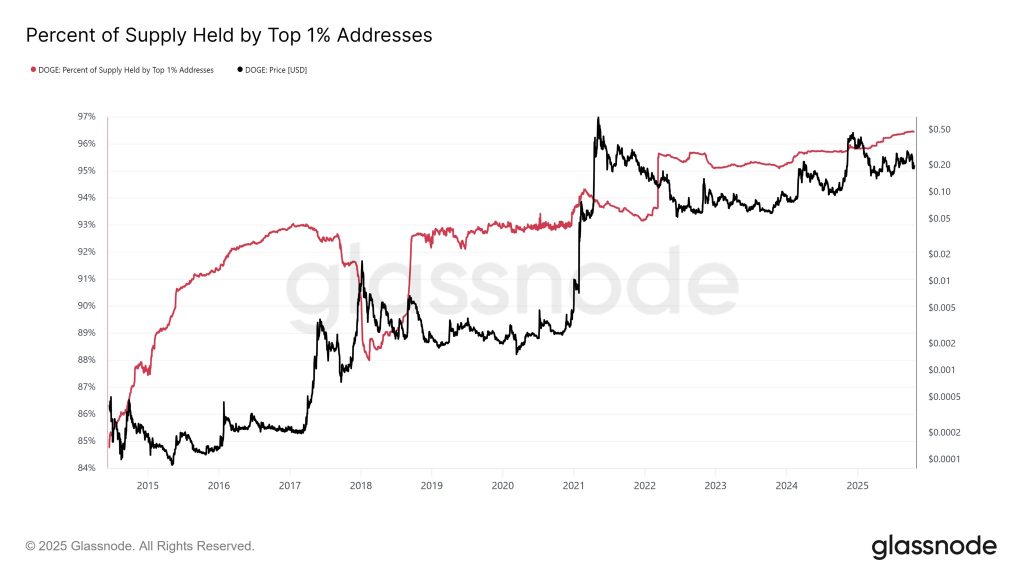

- Recent data from Glassnode, shared by analyst Cryptollica, shows that the top 1% of Dogecoin addresses now control nearly 97% of the total supply. What’s notable is that this concentration keeps growing even as DOGE’s price rises. The chart makes this clear: both whale holdings (red line) and price (black line) are moving up together, meaning major players aren’t selling despite recent gains.

- When whales accumulate during price increases, it typically points to long-term bullish sentiment. This pattern has appeared before major Dogecoin rallies, particularly during the 2021 bull run. If this continues, DOGE could be positioning for another significant move, potentially toward the $1.30 target mentioned by analysts.

- That said, such concentrated ownership does come with risks. If large holders start selling, it could create sudden volatility. For now, though, there’s no sign of distribution from these addresses.

- Dogecoin has moved beyond its meme origins. It’s being integrated into payment systems, tipping platforms, and could play a role in Elon Musk’s X ecosystem. This real-world adoption, combined with strong liquidity and on-chain activity, continues attracting both retail and institutional interest

Pingback: Dogecoin Price Forecast: Expansion Phase May Be Near - Finly.News