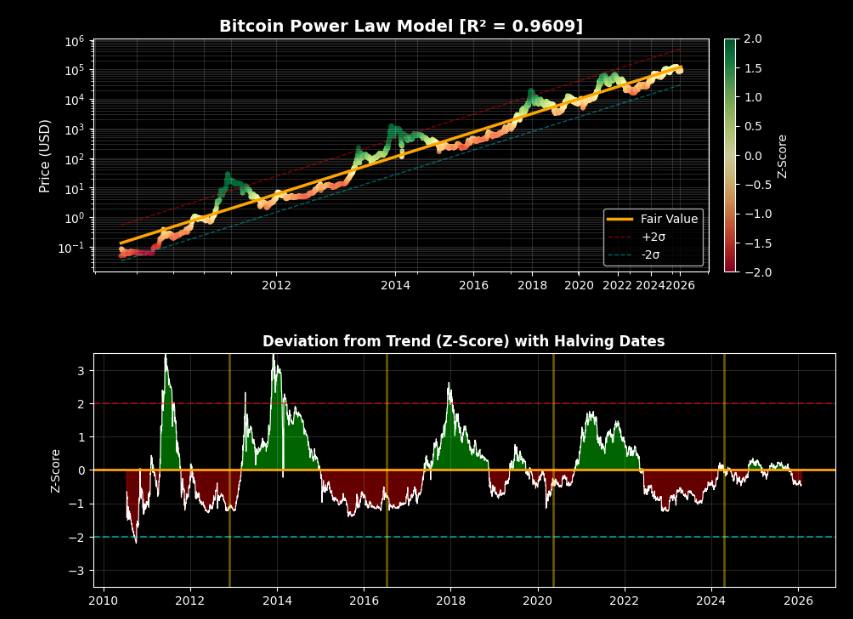

BTC Price Analysis: Bitcoin Trades 26.7% Below $122K Power Law Trend in January 2025

Bitcoin’s current market behavior is diverging sharply from historical post-halving patterns. Around 21 months after the latest halving event, BTC is trading near $89,500—approximately 26.7% below its estimated long-term power law trend value of $122,000. In prior cycles, Bitcoin typically traded well above trend at this stage, making the current setup historically unusual.

Key Market Signals:

Power Law Deviation and Cycle Position

Bitcoin’s position below the power law trend stands out given where the market sits in the halving cycle. Historically, comparable periods have been marked by speculative excess and elevated price premiums relative to trend. Instead, the current cycle shows structural restraint rather than exuberance.

As noted in the analysis, Bitcoin is trading near $89,500, roughly 26.7% below its estimated long-term power law value of around $122,000.

Leverage, Volatility, and Market Sentiment

Despite the extended cycle timeline, there are no signs of leverage-driven instability:

- Funding rates remain muted at roughly 1.5% annualized

- Implied volatility is hovering near 33%

- There is no evidence of FOMO-driven inflows or liquidation cascades

This combination suggests the market is not overheated and remains largely orderly.

Capital Flows and Price Structure

ETF activity has not been a dominant factor in recent price action. Outflows have been limited and continue to slow, while price action respects technical levels rather than reacting to emotional sentiment swings.

Bitcoin has remained range-bound, finding support near $85,000 while facing resistance above the $100,000 level. This behavior points to controlled trading conditions rather than speculative extremes.

Options Market and Gamma Dynamics

Options positioning appears to be the primary force shaping current price behavior. Positive net gamma exposure has been suppressing volatility and effectively pinning Bitcoin around the $90,000 region.

A critical inflection point approaches as approximately 43% of total gamma exposure is set to expire around January 30. While this does not guarantee a directional move, it removes a mechanical constraint that has been limiting price expansion.

Why This Matters

The absence of leverage excess, combined with suppressed volatility and strong technical respect, suggests the market is in a state of compression rather than distribution. Importantly, network fundamentals remain healthy, with hash rate trends holding up well relative to price.

Historically, prolonged compression phases do not persist indefinitely. When structural constraints ease, markets often experience volatility expansion.

Outlook After January 30

As a significant portion of gamma exposure rolls off, Bitcoin may become more responsive to directional flows. Whether the resulting move breaks higher or lower will depend on which technical boundary gives way first.

However, trading below the power law trend this late in the cycle is historically rare, increasing the probability of a meaningful move once volatility constraints lift.

Author’s Take

This setup resembles a coiled spring. With gamma pressure set to unwind and volatility artificially suppressed, conditions favor expansion rather than continued stagnation. The direction remains uncertain, but the longer compression persists, the more forceful the eventual move is likely to be.