BTC Holds Strong Weekly Candle as $94K–$93K Support Zone Comes Into Focus

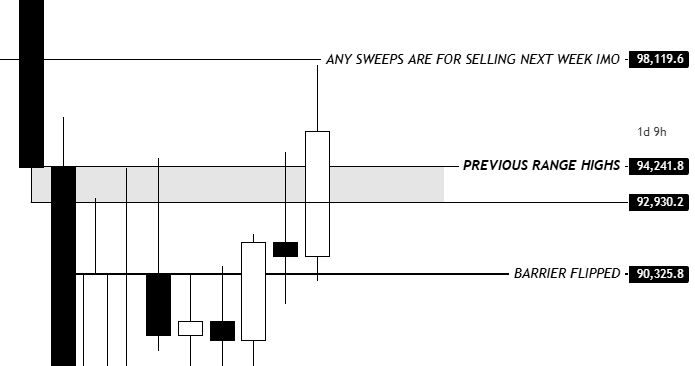

Bitcoin finished the week with a solid bullish close, reinforcing short-term momentum after pushing into the upper $90,000s. However, the next phase of price action hinges on how BTC reacts to a key demand zone between $94,200 and $92,900. This area previously acted as the top of the prior trading range and now represents a crucial technical inflection point.

Key Market Structure Levels

Weekly Candle and Demand Zone

The latest weekly candle reflects strong buying interest, but price is currently hovering just above the $94K–$93K zone. This region is now acting as support, and acceptance above it would confirm that the breakout remains valid.

If Bitcoin can hold above this demand zone, market structure remains constructive, keeping the path open for a move back toward $98,000—an area aligned with recent highs.

Downside Risk if Support Breaks

A failure to hold the $94K–$93K zone would likely trigger a move back toward $90,000. Such a decline would place Bitcoin back inside its previous trading range, shifting the market narrative from continuation to consolidation or correction.

As one analyst summarized:

Holding this region is central to the current market structure—acceptance above $94K keeps upside momentum intact, while a break below shifts the narrative entirely.

Lower vs Higher Timeframe Signals

If Bitcoin does slip into the low $90,000s, attention will turn to the yearly open and former range highs. This area would need to hold to establish meaningful support and prevent further downside.

At present, market signals are mixed:

- Lower timeframes continue to show bullish momentum

- Higher timeframes are flashing bearish signals

This divergence increases the risk that the recent push higher could resolve as a swing failure rather than a clean breakout.

Why This Level Matters

Bitcoin’s behavior around major range boundaries often sets the tone for the broader crypto market. With a strong weekly close already in place, early price action next week becomes especially important.

A renewed push higher could still form a lower high before a pullback, while early weakness would increase the probability of a deeper rotation into established support zones. In either scenario, the $94K–$93K area remains the defining level for near-term direction.

Outlook and Scenarios Ahead

Looking forward, the market faces two clear paths:

- Bullish continuation: Holding above $94K opens the door for a renewed test of $98,000

- Bearish rotation: Losing support shifts focus toward $90,000 and range re-entry

The reaction around this zone will likely determine whether Bitcoin maintains trend strength or enters a corrective phase.

Source: NEXTA