Bitcoin Whales Buy 54,000 BTC in Fastest Accumulation Since 2012

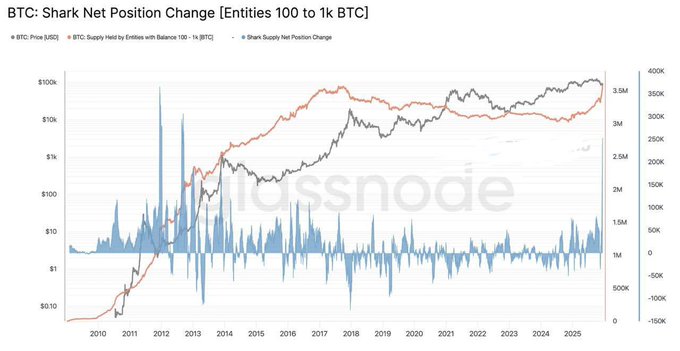

Bitcoin’s on-chain data reveals a dramatic shift in how large holders are behaving. Over the past week, whales snapped up roughly 54,000 BTC—that’s about $4.66 billion worth at today’s prices. The data focuses on entities holding between 100 and 1,000 BTC, commonly called “sharks,” and the charts show a clear spike in their buying activity.

What makes this accumulation stand out is the speed. This is the fastest rate these mid-sized whales have been buying since 2012. When you look at the historical data, recent purchases dwarf what we’ve seen during previous consolidation periods. Even with Bitcoin trading at elevated levels compared to earlier cycles, these large holders keep adding to their positions.

“Whales purchased approximately 54,000 BTC, equivalent to around $4.66 billion at current prices, marking the fastest accumulation rate for this cohort since 2012.”

The supply held by the 100–1,000 BTC group has been climbing steadily, meaning these players are absorbing available Bitcoin rather than selling it off. History shows that similar accumulation phases typically happen when experienced market participants position themselves before major market shifts. While there’s no guarantee of immediate price movement, sustained buying like this usually signals growing confidence among bigger players.

Why does this matter? Because what large holders do directly impacts liquidity and how Bitcoin supply is distributed across the market. When whales accumulate this aggressively, circulating supply shrinks, making the market more sensitive to demand changes. However, increased concentration among larger players can also amplify volatility if sentiment shifts. With accumulation hitting its fastest pace since 2012, traders are watching closely to see if this trend holds and how it plays out against broader economic and crypto market conditions.

My Take: This level of whale accumulation typically doesn’t happen in a vacuum. When sophisticated players move this fast, they’re usually positioning ahead of something bigger. The 2012 comparison is especially notable—that period preceded significant rallies.

Source: MartyParty