Bitcoin Price Analysis: Testing $117K Resistance

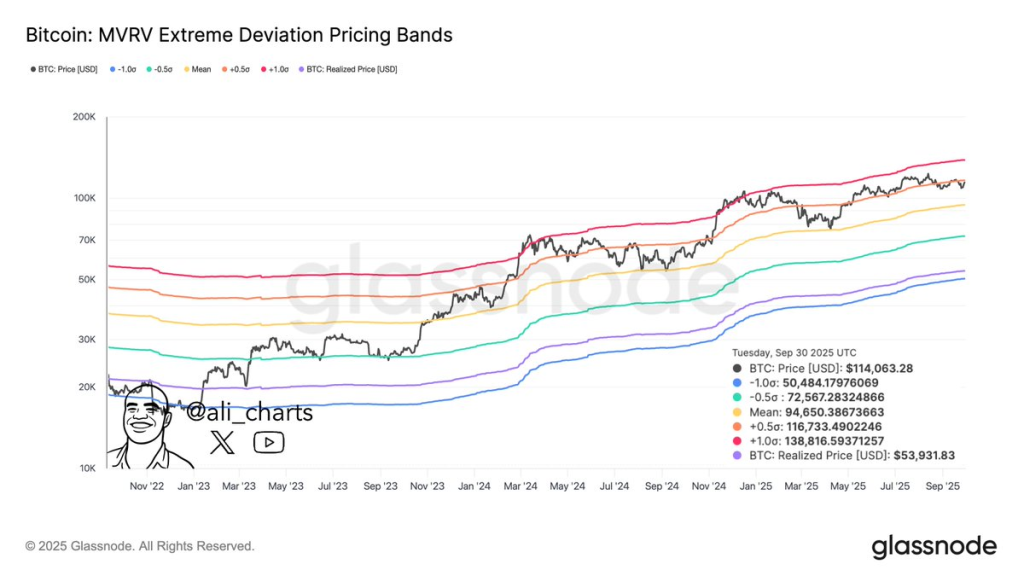

Bitcoin’s 2025 rally has brought the cryptocurrency to unprecedented levels. Trading above $114,000, BTC is now challenging a key resistance zone near $117K. According to on-chain metrics from Glassnode’s MVRV pricing bands, a successful breakout could open the door to $139,000 as the next major target.

Current Market Position

Market analyst Ali recently highlighted this technical setup, noting how Bitcoin’s market value is stretching beyond realized value benchmarks—a pattern that historically precedes significant price moves.

Bitcoin’s price action against MVRV deviation bands reveals several key levels: the spot price sits at $114,063 as of September 30, 2025, while the realized price of $53,931 shows that holders are sitting on substantial profits. The -1σ band at $50,484 marks historical bear market lows, and the mean band at $94,650 has been successfully broken, confirming the strength of the current trend. BTC is now testing the +0.5σ band at $116,733, with the +1σ band at $138,816 aligning closely with the $139K target.

The chart shows Bitcoin consistently climbing through these deviation bands, with periods of consolidation at each level. These bands have historically acted as both resistance during advances and support during pullbacks.

Forces Behind the Rally

The current surge reflects a combination of powerful market dynamics. Institutional demand through ETF inflows and fund allocations continues to accelerate, while broader economic conditions—including persistent inflation and accommodative monetary policy—are pushing investors toward hard assets like Bitcoin. Growing adoption as both a settlement layer and portfolio hedge is expanding on-chain activity, and supply-side dynamics remain tight following the halving event, with strong holder conviction limiting available coins.

Potential Scenarios

If Bitcoin breaks cleanly above $117K, momentum could quickly carry it toward the $139K level at the +1σ band. When BTC enters extreme deviation zones like this, moves tend to accelerate as new buyers enter and shorts cover. However, if resistance holds firm at current levels, a healthy pullback toward $94K—the mean band—wouldn’t be surprising. Such a correction would still fit within a broader uptrend and could provide a better entry point for new positions.

The coming weeks will likely determine whether Bitcoin consolidates its gains or continues pushing into new territory. With volatility likely to remain elevated, traders should watch for volume confirmation on any breakout attempt and be prepared for sharp moves in either direction as the market decides its next major step.