Bitcoin Holders Realize $4.5B in Losses on Jan. 23 — Highest Since March 2023

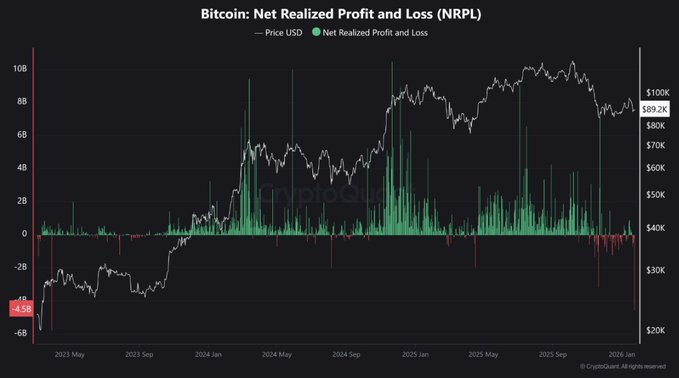

Bitcoin holders realized approximately $4.5 billion in losses on January 23, marking the largest single-day realized loss event since March 2023, according to on-chain data.

The sharp spike reflects mounting pressure on the market as Bitcoin continues to underperform while traditional store-of-value assets post new highs.

The data highlights growing investor capitulation amid prolonged price weakness.

Key Facts

- Realized Bitcoin losses reached $4.5 billion in a single day

- The event marked the highest daily loss total since March 2023

- Coins moved on-chain were sold well below their cost basis

- The sell-off occurred as gold and silver hit new highs, widening asset performance divergence

Market Context

Bitcoin’s inability to recover alongside other macro assets has left a large portion of holders underwater, particularly those who entered positions at higher price levels.

As downside pressure persisted, more investors opted to exit positions rather than wait for a potential rebound.

This divergence between Bitcoin and traditional stores of value appears to have intensified selling activity and reinforced negative short-term sentiment.

On-Chain Data Signals Capitulation

According to CryptoQuant, the Net Realized Profit and Loss (NRPL) metric recorded roughly $4.5 billion in realized losses on January 23.

The indicator measures the difference between Bitcoin’s selling price and its original acquisition cost for all coins transferred on-chain.

Analysts noted that a significant volume of BTC was sold at substantial losses, indicating widespread capitulation during the ongoing downtrend.

Why It Matters

Large-scale realized loss events often coincide with periods of heightened stress and volatility in crypto markets.

Why it matters:

- reflects growing psychological pressure on Bitcoin holders

- highlights capital rotation toward traditional assets

- may signal late-stage selling by weaker market participants

Historically, similar spikes in realized losses have occurred during advanced phases of market drawdowns.

What’s Next

While on-chain capitulation does not predict future price direction, extreme loss realization has often preceded periods of consolidation or stabilization in past market cycles.

Whether Bitcoin follows a similar path will depend on broader macroeconomic conditions, liquidity trends, and the return of sustained demand.

Source:

- Commentary referenced by TheCryptoBasic

- CryptoQuant — Net Realized Profit and Loss data