ADA Cardano Whale Holdings Drop as 120M ADA Leave Large Wallets

Cardano (ADA) is experiencing a notable shift in on-chain ownership trends as large holders reduce their exposure. Approximately 120 million ADA have been sold by whales over the past two months. The data highlights a steady decline in the total amount held by major wallets, indicating sustained distribution rather than a single large transaction.

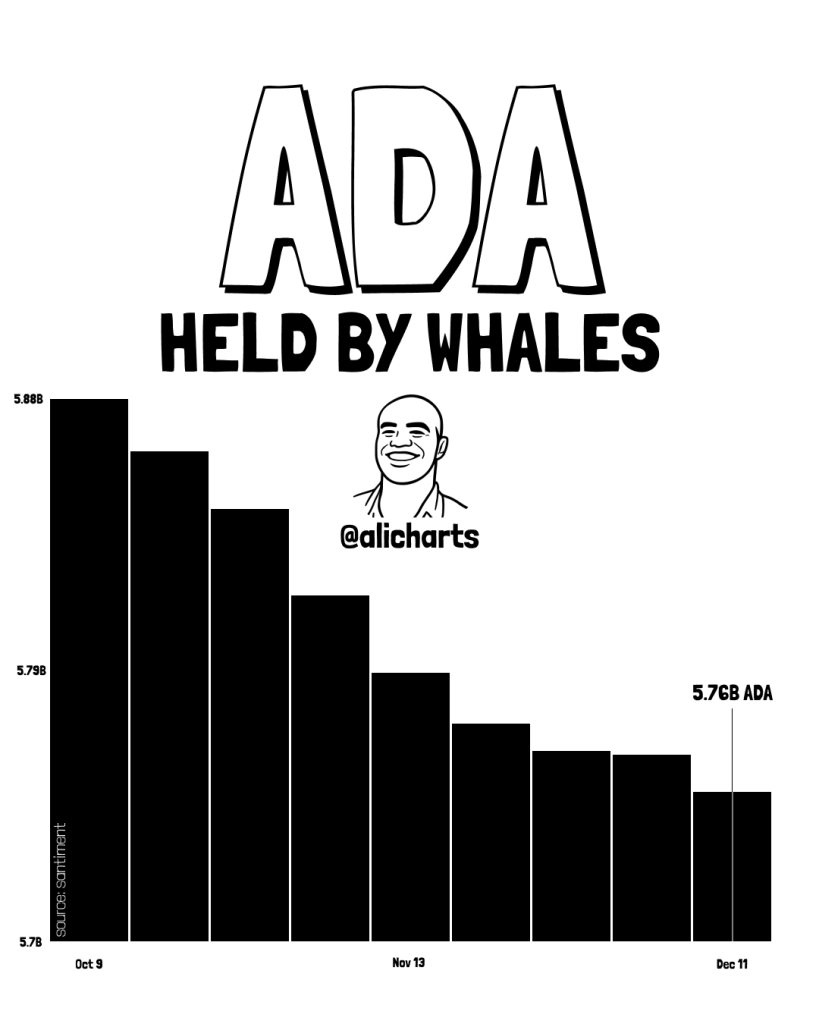

According to visual data from Santiment, whale-controlled ADA balances have fallen from around 5.88 billion ADA in early October to approximately 5.76 billion ADA by mid-December. The chart shows a gradual downward progression, suggesting that large holders have been consistently trimming positions over time. This pattern reflects measured selling activity rather than abrupt liquidation events.

The reduction in whale holdings has occurred without sharp disruptions visible in the broader on-chain trend. The steady slope in the data implies that liquidity conditions have allowed the market to absorb the released supply in an orderly manner.

“Such behavior is often associated with portfolio rebalancing or longer-term strategic adjustments by large participants rather than reactionary moves.”

This shift matters for the broader Cardano market because whale activity often shapes supply dynamics and market structure. A decline in concentrated holdings can influence how ADA responds to future demand changes and volatility cycles. Changes in whale positioning are closely watched as indicators of sentiment among large market participants, making this trend worth monitoring.

My Take: The 120 million ADA redistribution suggests whales are taking profits or repositioning strategically. While this reduces concentration risk, it also removes a layer of price support that large holders typically provide during market downturns.

Source: Ali Charts