Goldman Clients Hit 10-Year Bearish Low on WTI Oil as Sentiment Collapses

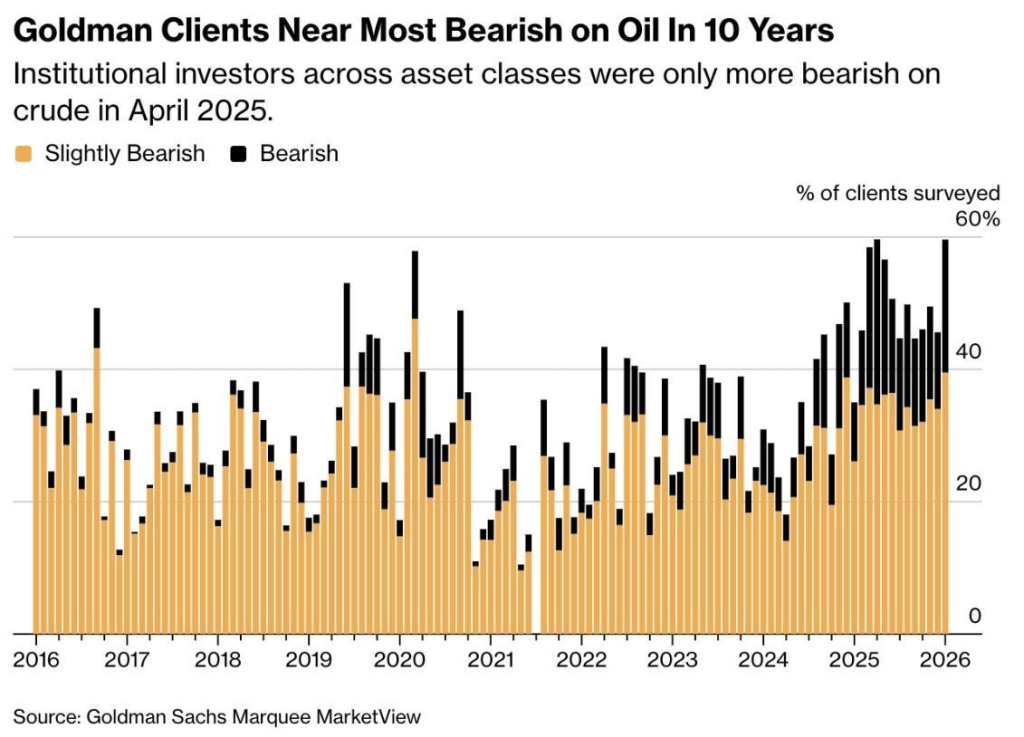

Institutional investors have turned overwhelmingly bearish on WTI crude oil, with client positioning tracked by Goldman Sachs falling to its most negative level in nearly a decade. According to data from Goldman Sachs’ Marquee MarketView platform, bearish sentiment among large investors is now close to extremes last seen in 2016.

Key Findings from Goldman Sachs:

1. Institutional Positioning Reaches Extreme Bearish Levels

The collapse in sentiment comes despite mounting signs of tightening supply across the global oil market. U.S. oil rig counts have been declining steadily for almost three years, signaling sustained reductions in drilling activity and long-term capital investment in upstream production.

The growing disconnect between deeply pessimistic investor positioning and tightening supply conditions suggests that oil markets may be approaching a critical inflection point. Historically, periods of crowded bearish sentiment combined with slowing production growth have often preceded sharp price reversals in commodity cycles.

Market commentary suggests that bearishness has become the dominant narrative in recent months, with limited room left for additional negative positioning.

2. Supply Signals Tell a Different Story

Despite extreme pessimism in futures markets, longer-term supply indicators remain supportive. Oil rig counts have been declining steadily for nearly three years, pointing to sustained reductions in drilling activity and capital investment.

This prolonged contraction in upstream supply suggests tighter market conditions ahead, creating a growing disconnect between investor sentiment and physical market fundamentals.

Why This Matters Now

WTI crude prices are currently testing major long-term technical support levels, adding significance to the positioning data. Historically, extreme one-sided sentiment combined with falling supply has often preceded major inflection points in commodity cycles.

When bearish positioning becomes crowded while production growth slows, even small catalysts can trigger sharp price moves as traders are forced to reassess risk.

The convergence of pessimistic sentiment, declining rig counts, and key technical levels places oil markets at a critical juncture.

Outlook

If supply discipline persists while sentiment remains deeply bearish, the oil market may be vulnerable to:

- Sudden sentiment reversals

- Volatility driven by short covering

- Stronger price reactions to geopolitical or macroeconomic events

The current setup suggests that downside expectations may already be heavily priced in, increasing the risk of asymmetric moves.

Sources:

- Goldman Sachs Marquee MarketView

- Commentary by Otavio Costa