EU Gas Prices Drop 40% to Pre-2022 Levels After Inflation Adjustment

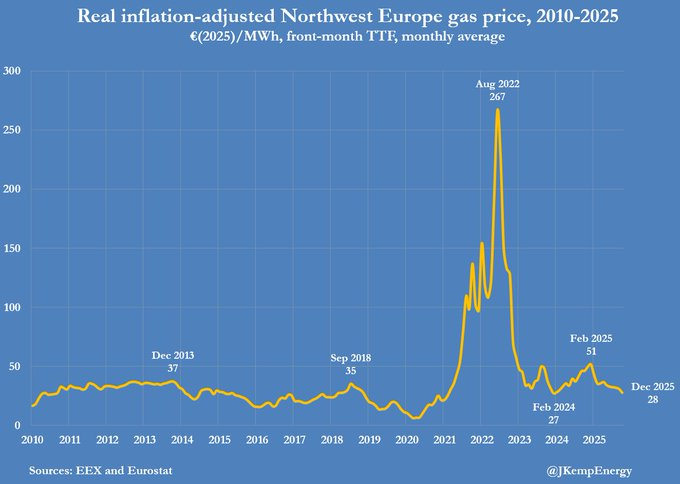

European natural gas markets showed clear signs of normalization in 2025 as inflation-adjusted prices fell back to levels last seen before the 2022 energy crisis. Benchmark Dutch TTF prices declined sharply, marking a decisive shift away from the extreme volatility that followed Russia’s invasion of Ukraine. The data suggests that Europe’s gas market has largely exited crisis mode.

Price Trends in 2025

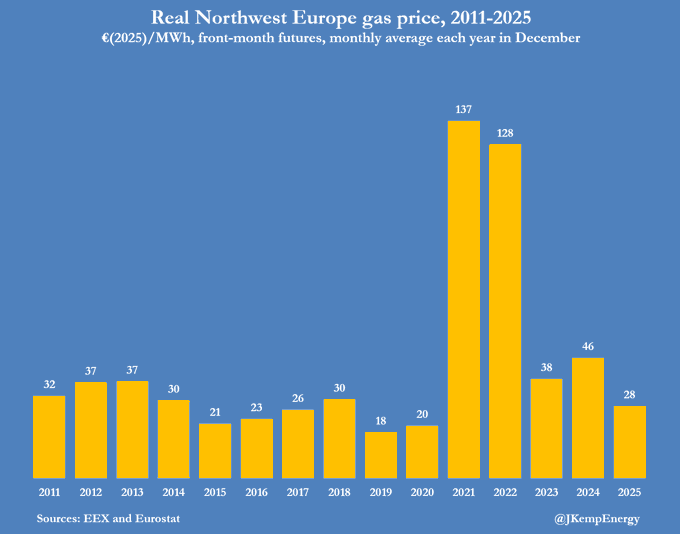

Front-month Dutch TTF futures averaged below €28 per megawatt-hour in December 2025, compared with more than €46 in December 2024 on a real (inflation-adjusted) basis. This represents a decline of roughly 40% year over year, confirming a sustained downward trend throughout the year.

Long-term pricing data highlights how unusual the 2022 surge was. Real Northwest Europe gas prices peaked at approximately €267 per megawatt-hour in August 2022, far exceeding any level observed during the previous decade.

Long-Term Context and Stabilization

By early 2024, inflation-adjusted prices had already dropped close to €27 per megawatt-hour. They then stabilized around €28 by December 2025, placing prices near historical norms.

During 2025, average real gas prices declined in eight out of twelve months, including every month from July through December. By year-end, prices were only about 7% above the 2011–2020 average, underlining how close the market has returned to pre-crisis conditions.

Why This Matters

Natural gas prices play a central role in Europe’s broader economy. They influence electricity costs, industrial production, and overall inflation. The return of Dutch TTF prices toward long-term averages indicates a more balanced supply-demand environment after years of disruption.

Lower real gas prices help reduce energy-driven inflationary pressure and contribute to greater economic stability across the region. While the market remains sensitive to weather conditions and geopolitical risks, the extreme volatility of the crisis period has clearly subsided.

Outlook

Looking ahead, gas prices are likely to remain closer to historical norms than to crisis-era extremes, assuming no major supply shocks. Seasonal demand, geopolitical developments, and infrastructure resilience will continue to influence short-term movements, but the structural normalization seen in 2025 suggests a more stable baseline for 2026.

Sources

- Analysis based on long-term Dutch TTF pricing data

- Commentary and data referenced from a Twitter post by John Kemp