Market Psychology: Between Belief and Complacency

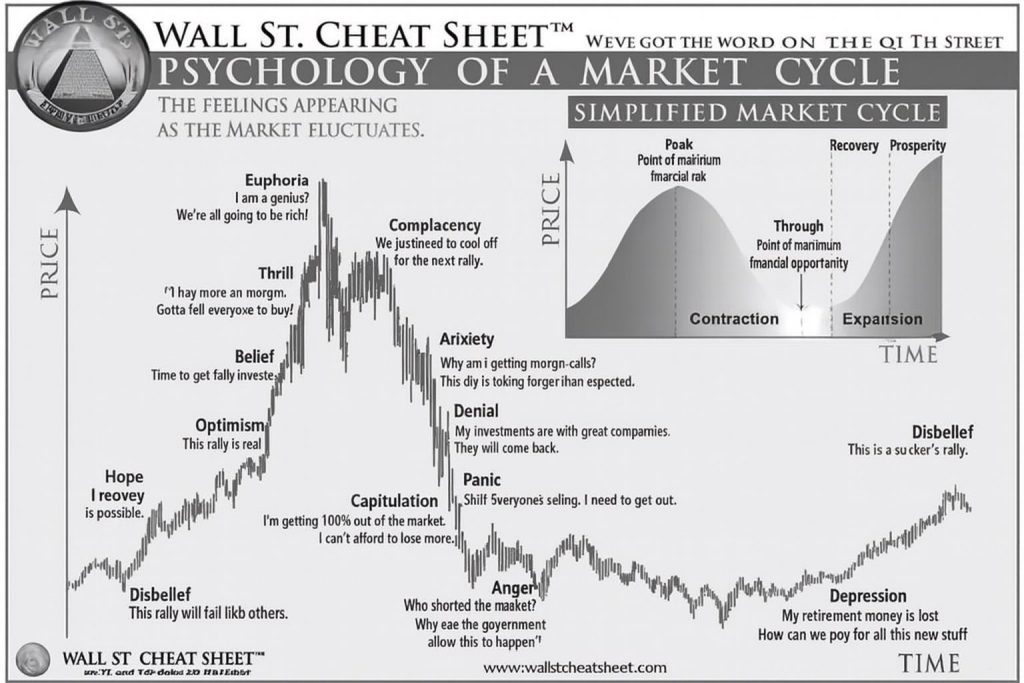

Markets always tell two stories. There’s the obvious one written in price charts and trading volumes. Then there’s the hidden one playing out in investor emotions and crowd behavior. The famous “Wall Street Cheat Sheet” maps these psychological stages from disbelief through euphoria to panic and despair. Right now, Ali is asking the million-dollar question: are we in the belief phase where real conviction builds, or have we slipped into complacency where overconfidence sets the trap for what comes next?

Current Market Dynamics

- The Belief Scenario: If we’re in belief mode, this rally has legs. Investors are getting genuinely confident the uptrend will continue. Every dip gets bought hard because people are thinking “this is my chance to get fully invested.” This phase typically drives some of the strongest market moves as both retail traders and big institutions pile in together.

- The Complacency Trap: But complacency looks almost identical at first glance. After a strong run-up, prices might flatten out or move sideways. Everyone assumes it’s just a breather before the next leg higher. The problem? Risk is quietly building while nobody’s paying attention. History shows complacency often marks the last calm moment before things get messy fast.

Why This Matters Right Now

Global markets are showing serious resilience again. We’re seeing better economic data, central banks talking about easing up, and trading volumes picking up. Bulls say this proves belief is back and we’re headed higher. But the skeptics point to stretched valuations, earnings that are starting to slow down, and mounting debt problems. They’re warning we might already be in the complacency zone.