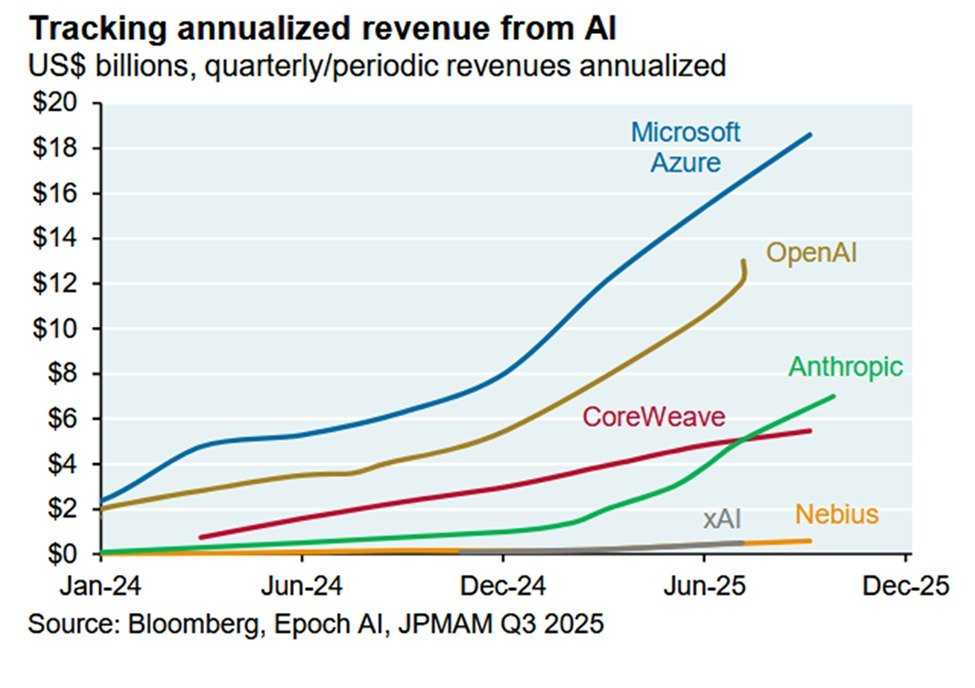

Microsoft Azure AI Revenue Surges to $18.5B in Q3 2025

Microsoft has reached a major milestone in AI monetization. As of Q3 2025, Azure AI is generating approximately $18.5 billion in annualized revenue, marking a fourfold increase compared to Q2 2024. The latest figures highlight how rapidly AI has shifted from experimentation to a core revenue driver for cloud providers.

These numbers come as part of broader industry tracking that shows accelerating demand for scalable, enterprise-grade AI services across the global cloud market.

Cloud and AI Revenue Leaders

Microsoft currently leads the AI revenue race among cloud providers. Azure AI’s $18.5 billion annualized run rate more than doubles its revenue from just six months earlier and places it firmly at the top of the market.

Other major players are also growing rapidly:

- OpenAI is generating approximately $13 billion annually, representing more than a fourfold increase since early 2024.

- Anthropic has reached close to $7 billion in annualized revenue, nearly doubling every two quarters.

- CoreWeave, an AI infrastructure provider, is now producing around $5.5 billion annually, driven by surging demand for AI compute.

Industry analysts note that most AI-related spending is flowing toward a small group of dominant platforms with proven infrastructure and scale.

Market Maturity and Adoption Trends

While leaders continue to accelerate, newer entrants remain in earlier monetization stages:

- Companies such as xAI and Nebius are still below the $1 billion annual revenue mark.

- The widening gap between incumbents and newcomers reflects rapid consolidation within the AI market.

- Enterprises increasingly favor established cloud platforms over building AI systems internally.

Why This Matters

The surge in Azure AI revenue signals a structural shift in enterprise technology spending. Businesses are no longer testing AI in isolated pilots—they are deploying it at scale across operations, products, and services.

Key implications include:

- AI has become a core revenue stream, not an experimental add-on.

- Cloud providers with mature infrastructure are capturing the majority of AI budgets.

- Scale advantages are reinforcing market leadership, making it harder for smaller players to compete.

This dynamic is reshaping competition across cloud computing, software, and AI infrastructure.

Outlook for 2026

Looking ahead, several trends are likely to define the AI market in 2026:

- Continued revenue concentration among Microsoft, OpenAI, and Anthropic

- Rising infrastructure costs that favor providers with global scale

- Faster enterprise adoption as AI becomes embedded in everyday business workflows

If current growth rates persist, the revenue gap between market leaders and smaller AI companies is expected to widen further.

Data Sources: The Kobeissi Letter