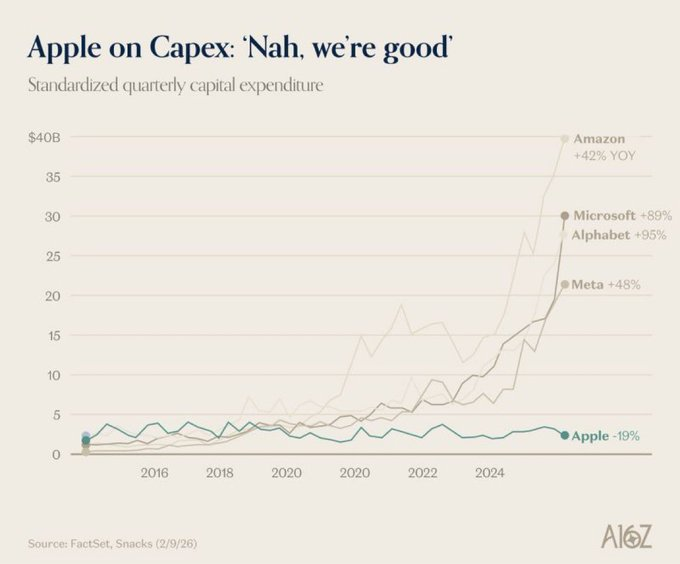

Apple Cuts Capex 19% While Big Tech Boosts AI Spending 42–95% in 2024

Apple reduced capital expenditures by 19% in 2024, while Amazon, Microsoft, Alphabet and Meta sharply increased spending on artificial intelligence infrastructure. The contrasting capital allocation strategies highlight a widening gap in how major technology companies are positioning themselves for the next phase of AI development. The data reflects a broader industry debate over whether long-term competitiveness depends on owning compute infrastructure or leveraging ecosystem integration.

Apple Moves Against the AI Infrastructure Trend

Major technology companies took sharply different approaches to artificial intelligence infrastructure spending in 2024.

Amazon, Microsoft, Alphabet and Meta significantly increased capital expenditures to expand data centers, AI chips and cloud capacity. Apple, by contrast, reduced capital spending by 19% year over year, according to recent financial disclosures.

The divergence underscores contrasting strategic views on whether long-term AI leadership depends on owning core infrastructure or leveraging ecosystem integration.

Capital Expenditure Split in 2024

Capital expenditure data shows a clear divide among major players:

- Amazon increased capex by 42% year over year

- Microsoft expanded spending by 89%

- Alphabet raised investment by 95%

- Meta boosted capex by 48%

- Apple reduced capital expenditures by 19%

While most large technology firms accelerated infrastructure buildouts to support AI workloads, Apple moved in the opposite direction during the same period.

The increase in spending reflects growing demand for AI compute power, custom silicon and expanded data center capacity across the industry.

AI Progress and the Infrastructure Formula

Investor Chamath Palihapitiya recently described AI development using a simplified framework:

AI progress can be summarized by the formula f(i) = p × c × a, where intelligence is driven by power, compute and algorithms multiplied together.

The model implies that AI capability scales with access to energy, processing capacity and algorithmic sophistication. Companies that invest aggressively in data centers and proprietary chips aim to control each of these components directly.

Amazon’s push into robotics automation illustrates how infrastructure investment extends beyond model training into logistics, operational efficiency and margin expansion.

Alphabet and Meta Double Down on AI Investment

Recent earnings results provide additional context for the infrastructure push.

Alphabet’s as growth expanded beyond traditional search, supported by AI-driven services and rising cloud demand. Meanwhile, Meta’s reflects investor confidence in its AI-focused transformation and large-scale infrastructure buildout.

Both companies appear to view AI infrastructure as a long-term competitive lever rather than a short-term initiative.

Apple’s Lower-Capex Strategy

Apple appears to be taking a more measured path. Instead of rapidly expanding AI infrastructure, the company may rely more on integration of third-party AI systems within its hardware ecosystem.

This approach limits near-term capital intensity and preserves financial flexibility. However, it also means Apple does not fully control the underlying compute stack compared to competitors investing heavily in vertically integrated infrastructure.

The strategic gap raises broader questions about long-term positioning in an AI-driven market.

Why It Matters

- AI capability increasingly depends on compute intensity and energy access

- Companies that own infrastructure may gain performance and cost advantages

- Ecosystem-driven strategies may remain viable if AI services stay modular

If AI progress continues to scale with infrastructure ownership, firms investing aggressively today could widen their lead. If AI tools remain interoperable and widely accessible, ecosystem-focused companies like Apple could maintain competitiveness without matching spending levels.

What’s Next

Future earnings reports and capital allocation decisions will provide further insight into whether Apple maintains its lower-capex stance or adjusts course in response to industry trends.

As AI infrastructure investment accelerates across the sector, capital discipline versus vertical integration is likely to remain a defining strategic debate among major technology companies.

Source: Twitter post by Chamath Palihapitiya