Alphabet Revenue Reaches $102.4B as Growth Expands Beyond Search in Q4 2024

Alphabet’s fourth-quarter 2024 earnings highlight a clear evolution in the company’s business model. While Google Search remains the primary revenue engine, faster growth is increasingly coming from Cloud, subscriptions, and AI-related services. The results point to a gradual diversification away from reliance on a single advertising-driven segment.

Key Revenue Breakdown

Google Search Remains the Core Revenue Driver

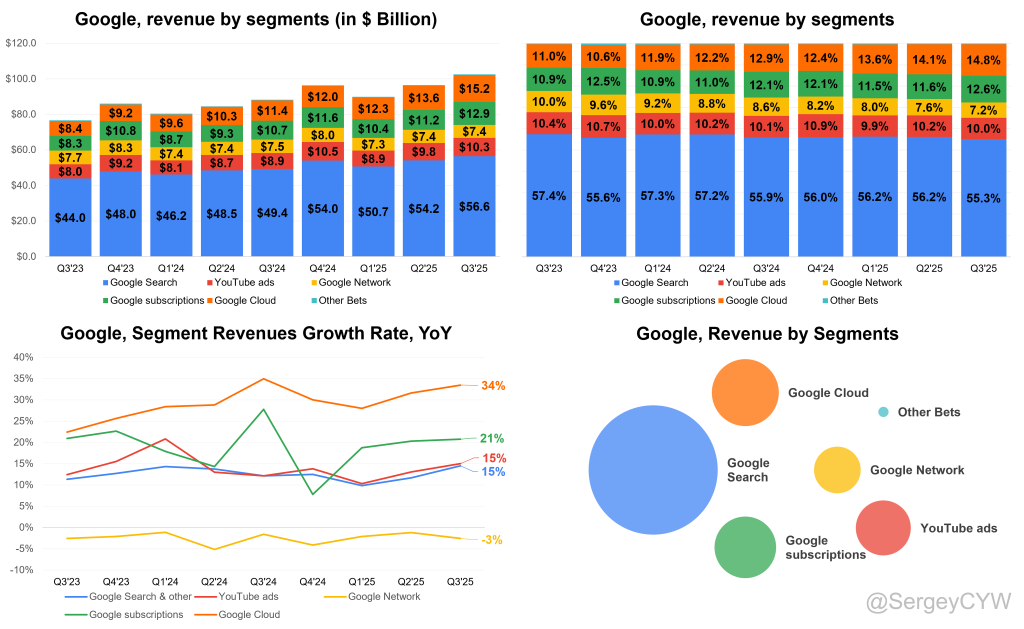

Google Search continues to anchor Alphabet’s financial performance, generating $56.6 billion, or roughly 55% of total revenue, during the quarter. Year-over-year growth reached 14.5%, demonstrating resilience despite ongoing interface changes tied to AI-powered search features.

Advertiser demand remained stable, confirming Search’s role as the company’s primary cash generator and the foundation that supports Alphabet’s broader ecosystem of products and investments.

YouTube Advertising Shows Accelerating Growth

YouTube Ads delivered $10.3 billion in revenue, marking 15% year-over-year growth and accounting for approximately 10% of total revenue. Improved monetization of Shorts and continued expansion in connected TV advertising strengthened YouTube’s position as a full-scale media platform.

By contrast, Google Network revenue declined to $7.4 billion, down 2.6% year over year, reflecting a broader industry shift toward first-party platforms and owned inventory.

Cloud and Subscriptions Drive Non-Ad Growth

Non-advertising segments are becoming increasingly significant contributors to Alphabet’s growth profile.

Google Subscriptions generated $12.9 billion, rising 20.8% year over year, supported by YouTube Premium, YouTube TV, and Google One. This segment provides recurring revenue and enhances long-term customer value.

Google Cloud delivered the strongest growth, reaching $15.2 billion, up 33.5% year over year. Enterprise adoption and demand for generative AI workloads fueled the expansion, while the segment also turned profitable, contributing more than $1 billion in quarterly operating income.

Why This Matters for Alphabet

Alphabet’s revenue mix illustrates a meaningful shift in strategic direction. While Search continues to fund the business, subscriptions add recurring stability, and Cloud—along with AI-driven services—represents the company’s next major growth phase.

This diversification reduces dependence on advertising cycles and positions Alphabet more favorably in an environment increasingly shaped by AI infrastructure, enterprise services, and subscription-based monetization.

Outlook

Looking ahead, Alphabet appears positioned for more balanced growth. Search is likely to remain the dominant revenue source, but Cloud and subscriptions are expected to expand their share of the overall mix. Continued investment in AI capabilities could further accelerate this transition and reshape Alphabet’s long-term earnings profile.